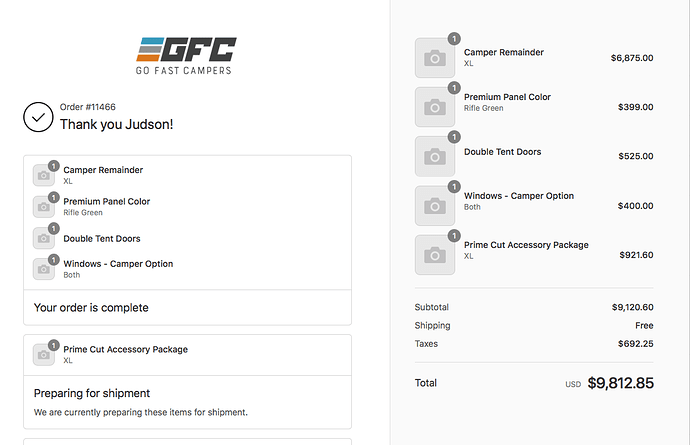

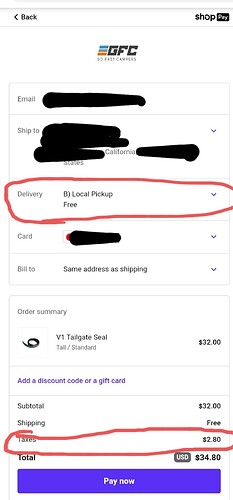

I first noticed over on the marketplace that someone from California was being charged tax on their gfc.because they shared their invoice.(attached below) A couple of other people chimed in stating they had not been charged tax. I just went on to the website to purchase an accessory and it is applying tax to that item whether it is picked up in person or delivered.(attached below) I called gfc to ask them about this and he said you should only have to pay tax if your item is delivered to California or a state that requires sales tax be collected. That guy’s invoice contradicts this because he stated the camper was going to be picked up but perhaps something will be fixed in regards to that. If what Colin said is true that means if you get white glove delivery service to California they will collect the tax so if you planned on dodging that like all of us do you can’t do it now. Your camper just got more expensive.

Has anyone in a tax collecting state been charged tax from GFC yet?

We are most definitely looking into immediately.

Like Mike said, will work on getting this sorted ![]()

Just to be very clear, if you live out of state in a location that has sales tax and pick up the product in Montana, this is not a tax loophole. And it applies to every product you buy from us.

While we are not required to collect taxes on local pickup products, you are legally obligated to pay taxes to your respective state on goods purchased out of state. The nuances of that can vary from state to state and it is up to the customer to understand their local tax laws.

This is foolishness. California is the most expensive state with the highest taxes. I lived there and worked in a small business. Only Miami and Florida are more expensive. You have to pay the tax for the delivery company already using white gloves. You can’t refuse since it’s probably included in the price. Accordingly, you must pay tax for services already included in the price. I would recommend that you fill out an individual 1040 https://pdf-to-dxf.com/blog/how-to-fill-out-schedule-c-form-1040/ type expense tax return. It will save you money, but there are amendments to the amendments to Forms 1040, 1040-A, 1040-EZ, 1040-NR or 1040-NR EZ.

It’s possible a Californian would by law be expected to declare and pay sales tax on purchases that were not taxed. You are supposed to self-report any shipped orders that are not charged sales tax.

These taxes fall under eCommerce and use tax. They vary by state. My place of residence is in California, where tax laws where use tax collection requirement for remote sellers will apply to taxable sales of tangible personal property to California consumers. So they have to charge me sales tax. Unfortunately no way out of it when it is ordered and paid for on line.

So you picked your camper up in Montana and still paid sales tax up front? There are several states that if you pick up an item in their state even if you purchase it online you don’t pay sales tax. I didn’t pay sales text and I’m pretty sure many others didn’t either in California. It’s a huge difference

I am not saying I did or didn’t, just providing what tax laws dictate. I order items on line from a number of different states and some I do have to pay tax and some I don’t. Doesn’t matter if I go get it or if I have it shipped.

But for California Tax law, if I didn’t pay tax on taking delivery in another state and I have it delivered or I bring it in to California myself, I am required to put the pay the sales tax in California.

I am always charged for the tax.