How much did it increase your insurance premium when you added the GFC?

thanks for PSA. sorry about the truck.

side note: I just called my agent/bud with state farm in Ohio. my camper is not covered under car insurance but under home owner’s policy as personal property with a separate $$$ deductible and claim if ever it were to be damaged in fire, accident or theft. but it is covered… and you were lucky. this was my favorite car I ever owned next to the hearse

$38/yr with allstate ($8k coverage)

Ugh, car accidents are the worst. Hope everyone was ok

I told them I had a camper on the truck, worth 8k, and they just confirmed it was in-bed (not towed) and that was it. I probably should call back and ask more specifics around type of coverage.

with geico a camper added @ $30 a year, and i also have ‘mods’ insured: bumpers - suspension etc - was an extra @ $25 i think. seems worthwhile to me

Same, I added it immediately (State Farm) it’s around 30 something bucks a year. Glad the accident wasn’t worse and that your family’s ok @TearingOut55

I’ve been waiting to get my truck back from the body shop since April. We had a crazy destructive hailstorm here - 70mph winds and baseball sized hail and parts are near impossible to get - new or used…My Wife’s Subaru went in April as well, but she finally got hers back about 3 weeks ago. Hope that your truck’s shop time is significantly less man. In fairness - my truck did look like an industrial sized golf ball…Gundam golf

Makes me queezy thinking about not having my truck for that long  that’s such a bummer. We’ve only had our gfc 2 weeks so I’m definitely not in a rush to get it to the shop. Having a smashed rear is a bummer but not as much as losing the rest of the summer camping season

that’s such a bummer. We’ve only had our gfc 2 weeks so I’m definitely not in a rush to get it to the shop. Having a smashed rear is a bummer but not as much as losing the rest of the summer camping season

More info, FYI, Allstate Colorado clarified camper insurance is comprehensive and collision for $38/yr. I also added “aftermarket equipment”$5k coverage, for suspension and whatnot, which was significantly more than camper coverage ($200/yr) but worth it to me after the scare we had.

Our Allstate was $36 a year for $7K In aftermarket add ons. They said it’s basically a topper worth x amount so should be fully covered minus deductible. In Utah with a few more things bundled

Oh damn! Glad you all are okay. I’m calling my insurance company now.

I also have State Farm and my agent told me that any permanent add-on to my vehicle is fully covered. What exactly are you adding to your annual premium? Perhaps this varies by state?

This post caused me to call my agent and get it in writing that my camper is covered in the event of a wreck, or theft, or what have you. Thank you for the PSA and good luck with everything.

I live in California and have USAA. Insurance Agent said that my auto policy covers the GFC as well since it is attached. I should also note that I have full comprehensive/liability coverage selected.

@docdave15 Not sure if it does by state, or just in the way the agent tries to add it? I know you don’t have to add suspension upgrades or other things like that, but the camper seemed to fall into a different category. Maybe I should ask more questions lol. It’s an additional 36 bucks a year, which is also why I didn’t question her. I probably should ask…

This is correct, State Farm doesn’t play the add-an-accessory, add-a-premium game, which is one doff the reasons they are great. If its on your vehicle and you can show a receipt, it’s covered.

–S

For an extra $4 a month for the first 5 years I get replacement cost of a brand new GFC camper, no matter the price. After 5 I get insured value of 7K. Not bad! $500 deductible.

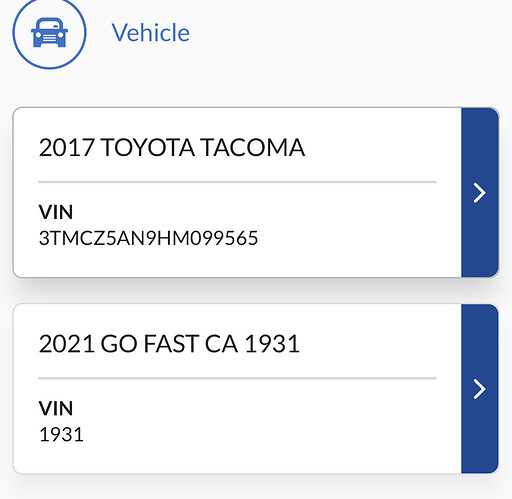

This looks like the Geico UI - was it as easy as calling them up and adding it with a stated value and your build#?

Yes. Use the build number as the serial number to make it less confusing. Add a couple of zeroes in front of it.

My insurance just so happened to be up for renewal so I inquired about additional equipment coverage at a few places. My GFC was not insured at this point in time. Here’s what I learned:

*State Farm: They’ll cover anything permanently bolted to the truck under your standard policy. However the two agents and underwriters I spoke to refused to cover the GFC once they learned it had fabric/tent sides (They looked it up themselves). They didn’t care it was essentially a hard shell when closed and vehicle was in operation. @seanpholman @docdave15 you may want to double check with your agents here. I know insurance is a bit of a game so you may have better luck than I did.

*Progressive: They’ll only cover up to $5,000 worth of additional equipment. This additional coverage would have added around ~$400 to my 6 month premium. The only way to get closer to the $7k value of the GFC in additional coverage is to opt for a stated amount policy. I would not recommend a stated amount policy in most circumstances.

*Farmers: Would only cover up to $1,000 worth of additional equipment. No exceptions.

*Geico: Agreed to cover up to $8,000 in additional equipment for about $8/month. Same experience as @GFCnortheast and @d.shaw. Standard premium was very competitive, too. I went with Geico and paid the 6 months in full.

*Disclaimer: Obviously take all of this with a massive grain of salt. Your individual situation, driving history, dependents, bundling, coverage needs, location, and relationship with insurer may net you different results. Take the time to call around and when it comes to insurance—don’t put too much weight in loyalty.