Our Allstate was $36 a year for $7K In aftermarket add ons. They said it’s basically a topper worth x amount so should be fully covered minus deductible. In Utah with a few more things bundled

Oh damn! Glad you all are okay. I’m calling my insurance company now.

I also have State Farm and my agent told me that any permanent add-on to my vehicle is fully covered. What exactly are you adding to your annual premium? Perhaps this varies by state?

This post caused me to call my agent and get it in writing that my camper is covered in the event of a wreck, or theft, or what have you. Thank you for the PSA and good luck with everything.

I live in California and have USAA. Insurance Agent said that my auto policy covers the GFC as well since it is attached. I should also note that I have full comprehensive/liability coverage selected.

@docdave15 Not sure if it does by state, or just in the way the agent tries to add it? I know you don’t have to add suspension upgrades or other things like that, but the camper seemed to fall into a different category. Maybe I should ask more questions lol. It’s an additional 36 bucks a year, which is also why I didn’t question her. I probably should ask…

This is correct, State Farm doesn’t play the add-an-accessory, add-a-premium game, which is one doff the reasons they are great. If its on your vehicle and you can show a receipt, it’s covered.

–S

For an extra $4 a month for the first 5 years I get replacement cost of a brand new GFC camper, no matter the price. After 5 I get insured value of 7K. Not bad! $500 deductible.

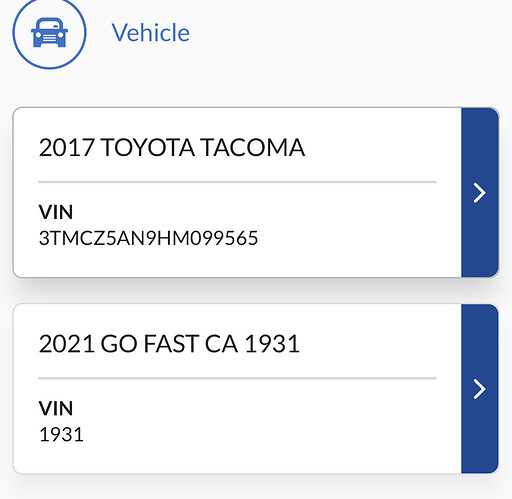

This looks like the Geico UI - was it as easy as calling them up and adding it with a stated value and your build#?

Yes. Use the build number as the serial number to make it less confusing. Add a couple of zeroes in front of it.

My insurance just so happened to be up for renewal so I inquired about additional equipment coverage at a few places. My GFC was not insured at this point in time. Here’s what I learned:

*State Farm: They’ll cover anything permanently bolted to the truck under your standard policy. However the two agents and underwriters I spoke to refused to cover the GFC once they learned it had fabric/tent sides (They looked it up themselves). They didn’t care it was essentially a hard shell when closed and vehicle was in operation. @seanpholman @docdave15 you may want to double check with your agents here. I know insurance is a bit of a game so you may have better luck than I did.

*Progressive: They’ll only cover up to $5,000 worth of additional equipment. This additional coverage would have added around ~$400 to my 6 month premium. The only way to get closer to the $7k value of the GFC in additional coverage is to opt for a stated amount policy. I would not recommend a stated amount policy in most circumstances.

*Farmers: Would only cover up to $1,000 worth of additional equipment. No exceptions.

*Geico: Agreed to cover up to $8,000 in additional equipment for about $8/month. Same experience as @GFCnortheast and @d.shaw. Standard premium was very competitive, too. I went with Geico and paid the 6 months in full.

*Disclaimer: Obviously take all of this with a massive grain of salt. Your individual situation, driving history, dependents, bundling, coverage needs, location, and relationship with insurer may net you different results. Take the time to call around and when it comes to insurance—don’t put too much weight in loyalty.

Im not sure about this. Ive added quite a bit to my truck, and as I add, I increase the number that i am insuring. I guess thats a stated amount? It might be cheaper that way. I have my truck insured for 40k - and with another junky car on the policy, i pay ~$85/month. I do have other policies on my account, and have been with progressive for 10+ years… I haven’t added my most recent mods, but they told me if i were to total my truck, i would just need to pay the deductible, and a check would be cut for the rest

I would encourage all to review Progressive’s Custom Parts and Equipment Value Policy. (From their site: "CPE coverage “typically” has a $5,000 limit.”) I would also encourage all to read about the pros and cons of holding an “Actual Cash Value” policy v. “Stated Amount” policy. The type of policy determines how the insurer values your vehicle (and additional equipment) at time of claim and determines the amount of the cut check for “the rest” after deductible payment.

Disclaimer again: The only statement I can actually guarantee and stand behind here is that each individual situation is going to be very different.

When I called to increase my coverage, I made them aware of the modifications that i have and they assured me that they were covered. I also have receipts for almost everything. They said they weren’t needed, but to keep them just in case. I haven’t called to add the GFC yet, but i will inquire again when i do

I appreciate everyone sharing their insurance costs for the GFC add-on. We have American Family for our house and vehicles and they are saying it is a modification and will be about $200 per six months! It’s good to have these figures from all of your various insurers to toss back at our insurance agent and point out their pricing is a bit nuts.

They also say they won’t add it until we send photos of it on the truck. Like when we are getting ready to drive home with it? Seems silly.

Working with our agent we ended up with a separate travel trailer policy through Progressive for $273 a year. Seemed like the best option and were able to use our build number as the serial number on the policy. Located in Denver for pricing reference.

Whoa I’m in the same area and Allstate is way way less (38/year!) , might be worth looking into. I do have multiple policies with them

I just tried to get my camper installed through Progressive and they said they didn’t cover that type of camper . . . maybe I should call back and try someone else, but they do seem to be more expensive than what other people are paying

I did go through our normal insurance broker and he handled the interaction with Progressive, to be fair. Also sounds like I’ll do some more research on my own to find a better rate, but at least for now we’re covered!

I have Geico and just insured it as an $8000 truck cap. Added $3.50/mo to my insurance